We deliver! Get curated industry news straight to your inbox. Subscribe to Adweek newsletters.

Nespresso has handed its global creative account to Publicis Groupe’s Leo, ending its almost two-decade relationship with IPG’s McCann, ADWEEK has learned.

A source with knowledge of the matter said McCann repitched for the business, along with WPP’s Ogilvy, and Omnicom-owned TBWA. ADWEEK understands Media was not included in the pitch. WPP handles planning and buying for Nestlé in Europe.

A source with knowledge of the matter told ADWEEK that McCann did project based work out of Paris and didn’t have any Nespresso projects scoped for this year.

While it will no longer work with the agency on flagship creative, Nespresso will to work with McCann Worldgroup and IPG agencies in other capacities, including with FutureBrand, UM, Weber Shandwick and MRMm the source said.

“We’re incredibly proud to have worked with this iconic coffee brand to turn it into a global phenomenon. From the highly successful collaboration with George Clooney to the power of the ‘Nespresso What else?’ platform, our partnership has created work that has built a new premium coffee brand around the world,” a McCann spokesperson said. “We wish the brand well in its next chapter and look forward to continuing our strong partnership across the many other ways we support the business.”

ADWEEK reached out to Nespresso and Leo for further comment. At the time of publication, they did not respond.

A Long Relationship

Nespresso, known for its colorful, premium coffee capsules and matching machines, has been driving the booming at-home coffee wave since 1986.

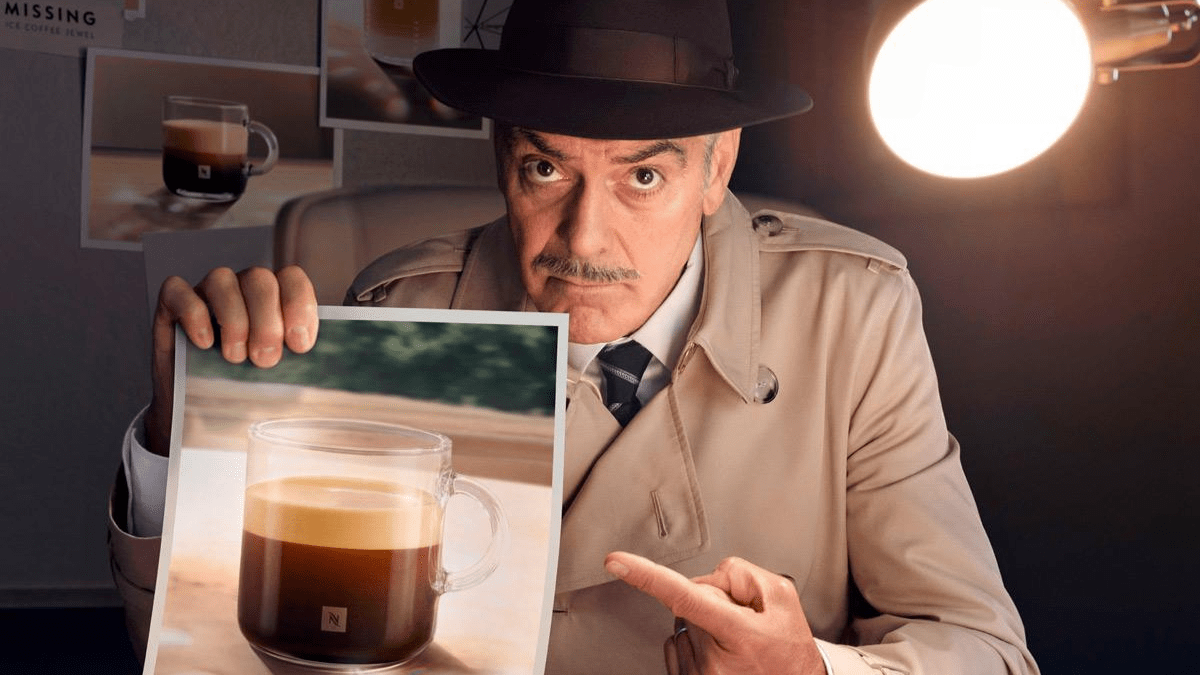

For 19 years, McCann has leaned on humour, sophistication, and A-lister appeal to promote its products around the world.

In 2006, McCann Paris debuted “What Else?”, Nespresso’s first global campaign. The work kicked off George Clooney’s longstanding role as brand ambassador.

Since then, the Ocean’s Eleven actor has fronted dozens of tongue-in-cheek spots highlighting the brand’s craftsmanship, featuring cameos from other celebrities, including Jack Black and, more recently, Eva Longoria.

Coffee has been a growth driver for Switzerland-headquartered Nestlé. Although the CPG giant saw sales decrease by 1.8% in 2024, organic growth was up 2.2%, bolstered by Nespresso, Nescafé, and Starbucks (which it owns the rights to sell in grocery and retail stores).

Bricks and Mortar and Canned Coffee

Nespresso has prioritized building awareness in the U.S. for the past decade. Since 2013, the coffee brand has opened numerous flagship boutique stores in cities including New York, San Francisco, Miami, and Beverly Hills.

Last September, it entered a surprising new era with a honey-infused chilled ready-to-drink canned product, Master Origins Colombia.

At the time, Nespresso’s vp of marketing and head of sustainability, Jessica Padula, told ADWEEK the U.S. launch was about keeping pace with on-the-go innovations in the market and building on the brand’s green credentials.

The launch was also an experiment in whether placing an ice-cold drink in the hands of Gen Zers could build enough affinity to influence their at-home consumption and potentially rescind countertop space to the brand.

Padula told ADWEEK last fall that Nespresso’s audience currently sits in the “30 to 50-year-old” sweet spot, AKA a stage in life where they’re buying home appliances. “But people start drinking coffee aged 14 or younger, in the U.S.,” she explained, saying there was a “big spread” between that first sip and the intent to purchase a machine.

She noted younger consumers were mainly drinking coffee outside of the home.

“That’s how they experience coffee when they’re younger, and we don’t super actively play in that space, so RTD should give us a little read into that,” she added.

Editors note: this story was updated with a statement from McCann on Wednesday May 28 at 12:54pm ET.